Year-End 2023 Review | 2024 Outlook

Q4 and Year-End Review Investor Letter

We begin our Year End Review and Outlook this letter with our best wishes for a prosperous and rewarding New Year. The last twelve months have been a rewarding period for all of our clients which makes it especially gratifying to share our year end point of view.

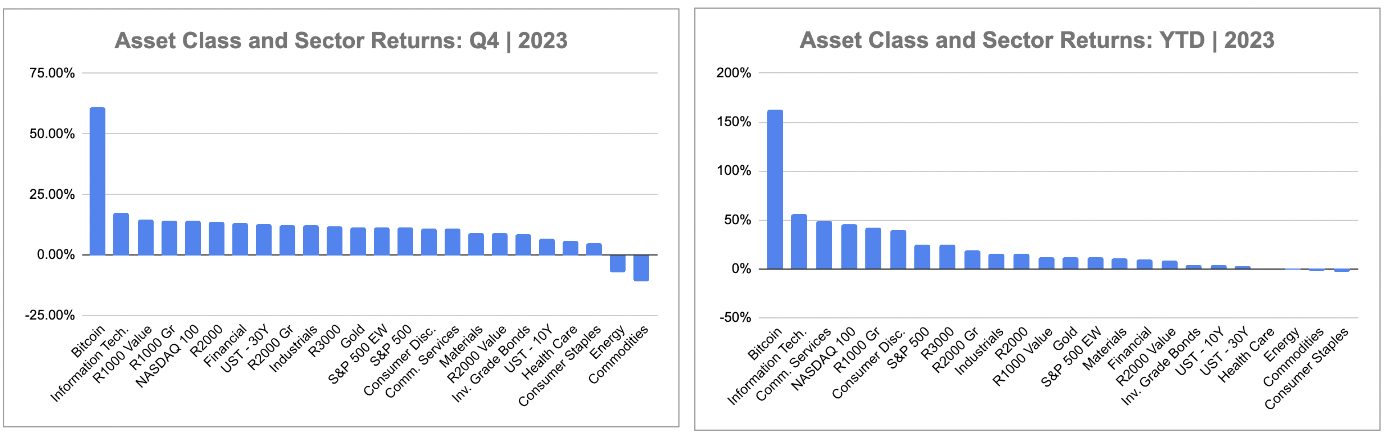

During the Q4 of 2023 the prospect of an accommodative shift in Fed interest rate policy propelled both equity and fixed income markets. The S&P 500 Index advanced 11% during the quarter and 24% for the year, while falling interest rates aided a recovery in bonds, especially at the long end of the curve. Indeed, 30-year treasuries rose 13% as yields dropped sharply. For the full-year, the long bond rose 2.4%.

Encouragingly, market breadth improved during the quarter with the S&P 500 Equal Weighted Index rising a bit more than its market-cap weighted counterpart. Prior to September, the EW index had lagged dramatically - it was down 3% for the first nine months of the year with 274 of the S&P 500 constituents declining more than 25% versus a 12% quarterly gain for the main index.

Riskier assets outperformed during the quarter with bitcoin up over 60% - the fiat alternative jumped a whopping 163% for the full-year as hopes grew that the SEC would approve the first-ever bitcoin ETF.

On a sector basis, technology stocks that had been pummeled in 2022 rose sharply, driven by enthusiasm around AI investment and solid fundamentals. Information technology advanced 17% in the Q4 and 56% for the year. Communication services and consumer discretionary stocks also rose, each up about 11% for the quarter while advancing 49% and 39%, respectively, for 2023. Energy was the only sector to lose money during the Q4, down 7% on declining oil prices while consumer staples was the singular loser for the year, falling 3%.

Style-wise, growth destroyed value for the year despite a 14% advance in the Russell 1000 Value Index for the Q4; for the year, R1000 Growth rose 42%, outpacing the R1000 Value Index by 3000 basis points.

On a relative basis, U.S. markets continued to outperform global peers with the S&P 500’s 25% gain smartly beating Europe, Asia/Pacific and Emerging markets, which climbed 19%, 15% and 9%, respectively, for the year.

Valuation-wise, with the S&P 500 closing the year at 4753, the market is trading at 19.4 times the current consensus earnings forecast of $245 for 2024. This represents an earnings yield of 5.2% versus the 10-year treasury yield of 3.8%. The implied equity risk premium of 140 basis points, is below the historical average, suggesting moderate downside risk to markets as investors digest the heady gains of 2023.

Wildcards in the mix are several, most of which have downside implications. Deteriorating consumer balance sheets, corporate headwinds related to rising interest expense tied to aggressive Fed rate hikes and the potential for margin compression should the economy weaken and/or inflation-aided pricing power diminish, all could disrupt the current sanguine consensus around “soft-landing.” Geopolitical risks are elevated with conflicts in Ukraine and the Middle East clear sources of exposure while China’s real estate sector, which accounts for 30% of that country’s GDP, appears shaky.

In our view, all this mandates both a research-driven active management approach as well as prudent diversification, both of which have been hallmarks of Roanoke’s strategy for the past four decades.

The Economy

The U.S. economy exceeded expectations during 2023. At the beginning of the year, most economists projected meager growth ranging from 0.3% to 1.7%; actuals are likely to approach 2.5% for the year. A pick-up in consumer spending, especially for services, augmented by a 1H surge in non-residential investment and increased residential expenditures powered the upside surprise.

For 2024, as was the case at the start of last year, growth expectations are muted with many forecasters predicting a slowdown. The Congressional Budget Office looks for growth of 1.5% for 2024 with others predicting sub-par gains of less than 1.0%.

A number of factors continue to contribute to heightened uncertainty in our forecasting. First, while pandemic-related restrictions on consumer activity are largely behind us, the economic aftereffects of massive fiscal stimulus and unprecedented monetary policy accommodation linger.

Low rates, powerful fiscal stimulus - which cushioned the impact of shutdowns tied to COVID for both consumers and businesses - and a historic expansion in the Fed balance sheet mitigated the impact of the pandemic. Household balance sheets exited the pandemic richer - by a lot, as shown in the following graph.

Hard to See Calamity Here: Household Wealth Up $30 Trillion

(Household Balance Sheet: 2019 - 2023)

Household wealth rose nearly $30 trillion during the pandemic to a near-record $151 trillion. Generous government transfers as well as solid wage growth once hiring resumed in earnest, propelled prosperity. The resilience of the labor market continues to surprise though recent trends have moderated somewhat

More Jobs, Substantial Pick Up in Real Wage Growth

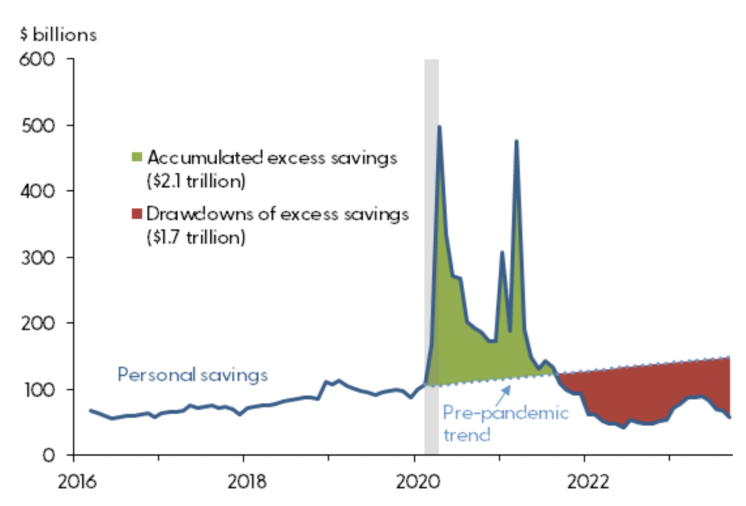

Strength in the labor market along with excess savings built up during the crisis bolstered consumer spending in 2022 and 2023. Over this time frame, consumers spent roughly $1.7 trillion of this “bonus” leaving around $400 billion in savings to support spending 2024.

Excess Savings Still Exceed $400 Billion

As we look forward to 2024, we expect an uptick in the unemployment rate tied to slower economic growth though we expect real wages gains to persist.

On the business side of the economy, activity slowed beginning in the 2H of 2023 as shown in the graph below which reflects the S&P Composite Activity Index. A reading under 50 indicates contraction. In recent months, while service activity has remained relatively solid, manufacturing has contracted, an observation consistent with the GDP report which showed a slowdown in private investment in the second half.

S&P Composite Business Activity

(<50 = contraction)

The passage of the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA) represent incremental stimulus approaching $1.4 trillion; we’re hearing from companies that these programs are starting to have meaningful impact on revenue run rates, a potential offset to weakness in the broader economy.

Nearly $2 Trillion in Stimulus

Outlook for Corporate Profits

We believe that the pick up in inflation that began in early 2021 and which peaked in July 2022 contributed to both sales momentum and margin gains observed throughout those periods. Margins, which troughed in the depths of the pandemic at around 10.0%, rose 300 basis points to over 13% by the beginning of 2022 before declining in 2023. Margin compression coincided with a moderation in inflation, a trend that could continue into 2024. Overall, profits for the S&P500 are expected to have increased about 3% in 2023 to $225 per share.

Consensus forecasts call for an accelerated growth trend in 2024 with earnings expected to rise nearly 10% with another double-digit gain predicted for 2025. The aforementioned fiscal stimulus spurring industrial production will certainly help, as will increased investment in new technologies, particularly involved artificial intelligence applications but it’s difficult to see these factors outweighing a run-off of excess consumer savings, rising unemployment and declining pricing power, suggesting the potential for downside surprise and auguring for a defensive portfolio posture.

Credit Markets and Inflation

The old adage “don’t fight the Fed” took center stage throughout 2023. The year began with expectation of economic malaise and when that didn’t appear, focus shifted to narratives around “higher for longer” and increasing term premia. Towards the end of the year, it became clear that inflation was beginning to abate, taking pressure off the Fed and signaling that this hike cycle was, in the very least, on pause with the potential for several rate cuts through 2024.

This shift in policy led to a powerful bond rally with the ten year note, which had peaked in October at over 5.00%, dropping over 100 basis points to 3.8%.

Ten-Year Treasury Note Yield

Cooling labor markets, subdued economic activity and falling commodity prices should result in continued moderation in inflation trends. Housing and shelter costs, which represent a significant portion of the CPI Index, are likely to remain mixed - affordability is at historic lows, and liquidity is limited because many homeowners are locked into low interest rates; that said, inventory levels are rising, which could produce some relief as the year progresses.

Market Implications

The prospect of more accommodative Fed policy along with moderating inflation ignited a powerful Q4 rally in both equity fixed income markets. While equity market gains remain highly concentrated - the “magnificent seven” stocks in the S&P500 Index accounted for a substantial portion of the overall price and earnings gain for the year, breadth improved during the fourth quarter.

Currently, consensus expectations have centered around the “soft landing” narrative as opposed to the prognostications of doom that dominated the talk track at the beginning of 2023. At that time, our point of view was that, while we recognized important negatives, all that negativity was known and, in our opinion, already incorporated into equity prices which had declined 22% in 2022. Our constructive stance turned out to be the right one.

At this point, we see many market participants are both (1) perhaps overestimating the speed with which the Fed will lower interest rates and (2) underestimating the potential negative impact on margins of reduced corporate pricing power. If we’re right on (1), then valuations, currently 300 basis points above historical averages and higher than warranted given where the risk free rate currently stands, are too high by maybe 10%. If (2) is right, and margins revert a teensy bit toward their pre-pandemic levels, then earnings forecasts - which currently anticipate margin expansion - are too high.

So, we’re cautious but believe that this market environment makes passive investment strategies particularly imprudent. Roanoke’s style of appropriate diversification, tax-aware portfolio construction and a long-term investment orientation provides important ballast to windward in uncertain times. Our ability to identify winning business models over the long-haul, irrespective of macro considerations, which are currently very much in flux, is particularly impactful today.

As always, if we can clarify or elaborate upon our current thinking, please be in touch. We like hearing from you.