Year-end Review and 2023 Outlook

Roanoke Asset Management

The old adage “don’t fight the Fed” was never more apt than in 2022, a year of stunningly bad performance across virtually every asset class. Equities fell nearly 20% while bonds, normally a safe haven, turned in their worst performance in over 50 years.

Source: S&P Capital Markets, RAM Research, TradingEconomics, Inc.

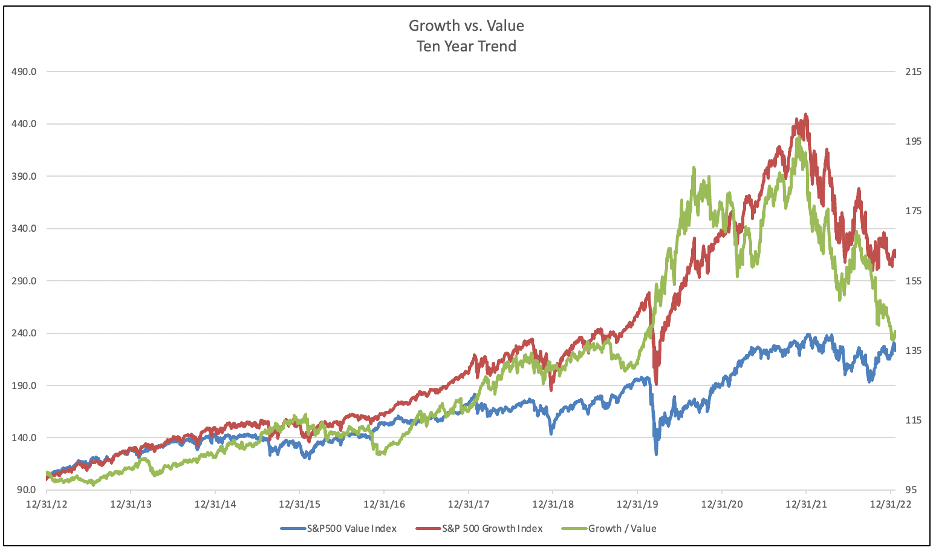

Within the equity markets, risk assets and economically sensitive sectors underperformed - communication services and technology falling 37% and 27% respectively, while the consumer discretionary and real estate sectors dropped more than 25%. Defensive industries fared better with consumer staples and health care declining under 2%. Commodities and energy were the only two major categories to post positive returns for the year. Style-wise, S&P Value outperformed S&P Growth by 3000 basis points for the year.

While bonds generally provide an anchor to windward during periods of heightened volatility, fixed income did not offer ballast for 2022 with bonds dropping significantly as interest rates trended higher. Long duration securities were hit particularly hard, with the 30-year Treasury declining 30%.

The carnage in the equity and fixed income markets was driven by accelerating inflation and concomitant efforts by the Federal Reserve to cool the economy and contain price increases. In contrast to Fed-speak throughout most of 2021 when both Treasury Secretary Yellen and Chairman Powell characterized inflation as “transitory,” a consensus emerged that the potential for sustained upward price momentum warranted a further tightening of monetary policy.

Accordingly, in addition to reducing the size of its balance sheet and effecting an unprecedented contraction in the money supply, the Fed initiated an unusually aggressive series of rate hikes with Fed Funds ending the year at 4.25 - 4.50%, up from 0.25% at the end of 2021.

Fed Funds Rate

Source: New York Federal Reserve

Source: St. Louis Federal Reserve

While these efforts have begun to take effect with December core inflation declining markedly from the June peak, inflation remains elevated and well above the Fed’s stated target of 2.0%. However the futures market does anticipate a further decline to 2.4% over the next five years. The yield curve, which has been inverted since July, also suggests a moderating rate environment in the intermediate-term and heightened potential for a contraction in economic activity.

Source: St. Louis Federal Reserve

With labor accounting for as much as 70% of total input costs, the degree to which restrictive monetary policy drives moderating inflation will ultimately rest on the jobs market. Nominal wage growth remains elevated and the unemployment rate has been hovering around historic lows.

We do believe that Fed policy actions will cause the labor market to soften - we’d note a proliferation of layoff announcements, especially in the technology sector - but don’t see a return to the benign cost environment that prevailed from 2009 - 2018. Specifically, the labor force participation rate remains nearly 200 basis points below pre-pandemic levels which has resulted in upward pressure on wages. This is partly due to a shift in preferences but also to demographic shifts with older age cohorts characterized by lower labor force participation rates representing an increasing proportion of the total workforce.

Overall, we see Fed policy and weakening consumer demand dampening economic activity through 2023 and into mid-2024 with below trend GDP growth and the possibility of a recession.

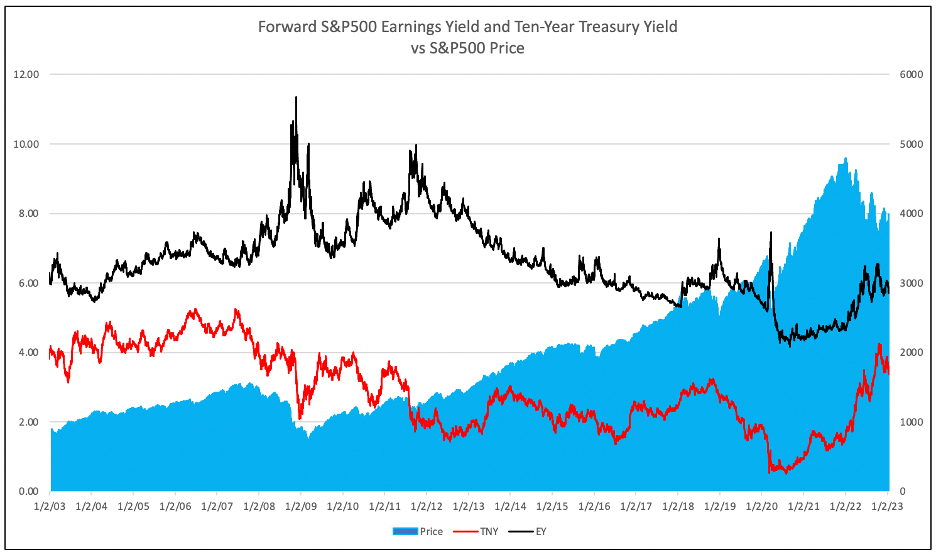

S&P 500 earnings forecasts do not, in our view, fully reflect this potential downside with the average strategist anticipating just a 3-4% decline in earnings to $210 followed by a robust recovery for the full year 2024. Assuming 10-year rates continue to soften to the 2.75% - 3.00% range, and a typical equity risk premium, we see the market trading between 16 and 18 times forward earnings, suggesting a range of 3360 - 3780 for 2023 and a target of 4150 in 2024. As such, we find the market fairly valued currently with a downside bias.

Source: Factset, RAM Research

That all being said, one ray of hope lies in the fact that our macro assessment aligns pretty well with the range of Wall Street strategists - most firms are equal or underweight equities, all - save one - expect below trendline returns for U.S. stocks over the near- to intermediate-term. With such unanimity, we see the potential for upside surprise. In other words, if the investment community expects disappointing earnings, perhaps it is already more or less priced into the market. Moreover, the current environment should be one favorable to our investing style - active management with deep research and knowledge driving investment decisions rather than passively riding with the herd.

The companies in your portfolio represent the very best of American innovation - market share gainers and creators of entirely new markets. Currently, the superior growth prospects and financial characteristics are valued in line with the broader, non-financial market despite the macro headwinds and decidedly inferior return and growth characteristics. As such, while we recognize the headwinds and macro uncertainty, we think it’s time for growth to shine, particularly given the sectors dramatic 2022 underperformance.

Source: Factset, RAM Research

As always, we are grateful for the trust you’ve placed in us and are available to elaborate on either our macro view or any portfolio and/or stock specific questions you may have. Please reach out to us, we like hearing from you.